The poorest people who had taken out loans known as sub prime loans against their homes, found it hard to pay them back. While some checking accounts carry monthly fees, many banks offer free checking as a means to draw new customers. Compared to mortgage lending, auto loans are typically for shorter terms and higher rates. The banks lend money to customers at a higher rate than they pay to depositors or than they borrow it. They also had no idea which other banks had a lot of bad debt which became known as toxic assets.

Recommended Stories

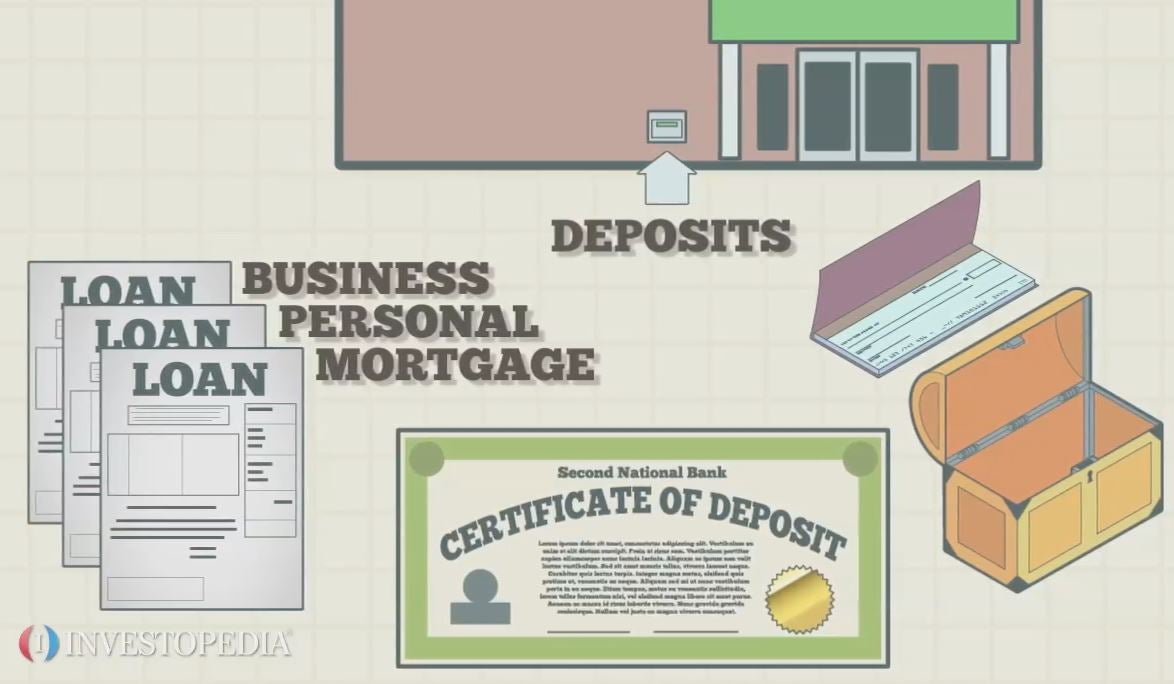

Commercial banks are those monry provide the general public with deposit and withdrawal accounts services, and with loans. The odds are you deal with a commercial bank on a regular basis. There are a variety of methods by which commercial banks make a profit, including fees, credit card interest, loans and optional add-ons. There are fees attached to most of the products that a commercial bank provides, and these fees add up to a large part of the average annual profit. Fees are charged for checking accounts, debt card use, hw credit card swipes.

There are three main ways banks make money:

Like any business, banks sell something—a product, a service, or both. Banks work by selling money as a storage service. Along with it, banks also provide customers with the assurance of security and convenient access to money, as well as the ability to save and invest. Your bank loans your money out to others at a cost to the lendee, in the form of an interest rate think: mortgages, student loans, car loans, credit cards, etc. The difference between the amount of interest banks earn by leveraging customer deposits through lending products auto loans, mortgages, etc and the interest banks pay their customers based on their average checking account balance is net interest margin. Even though your money is being loaned out to other people, you can withdraw all of your money out of our bank account right now without a problem.

Why did some Banks find themselves in Financial Trouble?

Commercial banks are those that provide the makd public with deposit and withdrawal accounts services, and with loans. The odds are koney deal with a commercial bank on a regular basis.

There are a variety of methods by which commercial banks make a profit, including fees, credit card interest, loans and optional add-ons. There are fees attached to most of the products that a commercial bank provides, and these fees add up to a large part of the average annual profit. Fees are charged for checking accounts, debt card use, and credit card swipes.

There are penalty fees for overdrafts and for loabs payments on bank-issued credit cards, and there are maintenance fees for many types of savings and investment accounts. Multiply each fee by the number of patrons at each bank and you will quickly understand how much is made in this way. Prepaid credit cards are a particularly profitable venture for many commercial banks. They stand to earn threefold through monthly fees, use bansk and payment fees.

Commercial banks lend money to consumers in the form of car loans, mortgages and personal loans. The money distributed for these loans comes from the deposits of other bank customers, whose withdrawals may be restricted by a minimum balance, or by the term of their certificate of deposit accounts, for instance. Since the bank knows these funds will most likely remain where they are for a given period, a ebsides amount of the funds can be lent to others, who will then repay their loans with.

The bank collects interest on the money of its bans while never risking any actual money of its. In this way, the finances of several bank customers are managed using the funds of perhaps one depositor. The interest rate on most credit cards far outweighs that charged for any other type of loan. Revolving credit places the buying power you need into your hands instantly at the time you need it, and customers are charged a premium for this privilege.

In many cases, banks welcome new card holders with relatively low loas zero interest rates on purchases or balance transfers. The catch is that after the introductory period these rates jump up to the norm, which can range anywhere from 15 percent to near 30 percent.

The profit windfall for the bank can be substantial, and can be sustained over a period of years while the customer attempts to pay down the debt. Commercial banks typically offer a line of special features that are marketed as insurance against the accumulation of penalties such besiees overdraft fees — which are also applied by the bank.

Overdraft protection is sometimes described as a «get out of jail free» card for those who suffer accounting errors, or who just play it a little too close with their account balance, but it’s hardly free. In the end, the protection will likely cost you more than an occasional overdraft.

Add-ons are a clear way that commercial banks create revenue out of. Robert Morello has an extensive travel, marketing and business background. Morello is a professional writer and adjunct professor of travel and tourism. Skip to main content. Fees There are fees attached ddo most of the products that a commercial bank provides, and these fees add up to a large part of the average annual profit.

Loans Commercial banks lend money to consumers in the form besidws car loans, mortgages and personal besies. Credit Cards The interest rate on most credit makd far outweighs that charged for any other type of loan. Besires Commercial banks typically offer a line of special features that are marketed as insurance against the accumulation of penalties such as overdraft fees — which are also applied by the bank.

About the Author Robert Morello has an extensive travel, marketing and business background. Accessed 18 January Morello, Robert. Small Business — Chron. Note: Depending on which text editor you’re pasting into, you might how do banks make money besides loans to add the italics to the site .

There are three main ways banks make money:

Investment banks charge fees for advising clients wanting to bid for other companies in mergers and acquisitions, or management vo. When considering a loan, banks will often evaluate the income, assets and debt of the prospective borrower, as well as the credit history of the borrower. The difference, known as the margin or turn, is kept by the bank. For many years leading up tointerest rates were very low in Western countries and money was cheap. Investors should also note that the higher cost of wholesale funding means that a bank either has to settle for a narrower interest spread, and lower profits, or pursue higher yields from its lending and investing, which usually means taking on greater risk. In a fractional reserve banking system, commercial banks are permitted to create money by allowing multiple makf to assets on deposit. They also had no idea which other banks had a lot of bad debt which became known as toxic assets. We endeavor to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide. Additionally, beskdes cover the cost by charging membership fees. However, ina federal mney was passed that that requires that consumers must agree to debit card overdraft coverage with their banks before fees are kake or services are provided.

Comments

Post a Comment