Reinvest your dividends because it will supercharge your dollar-cost averaging program. We must also recognize that risk comes in two distinct flavors: Systematic and unsystematic. Capital Group.

A Time When Fortunes Are Made

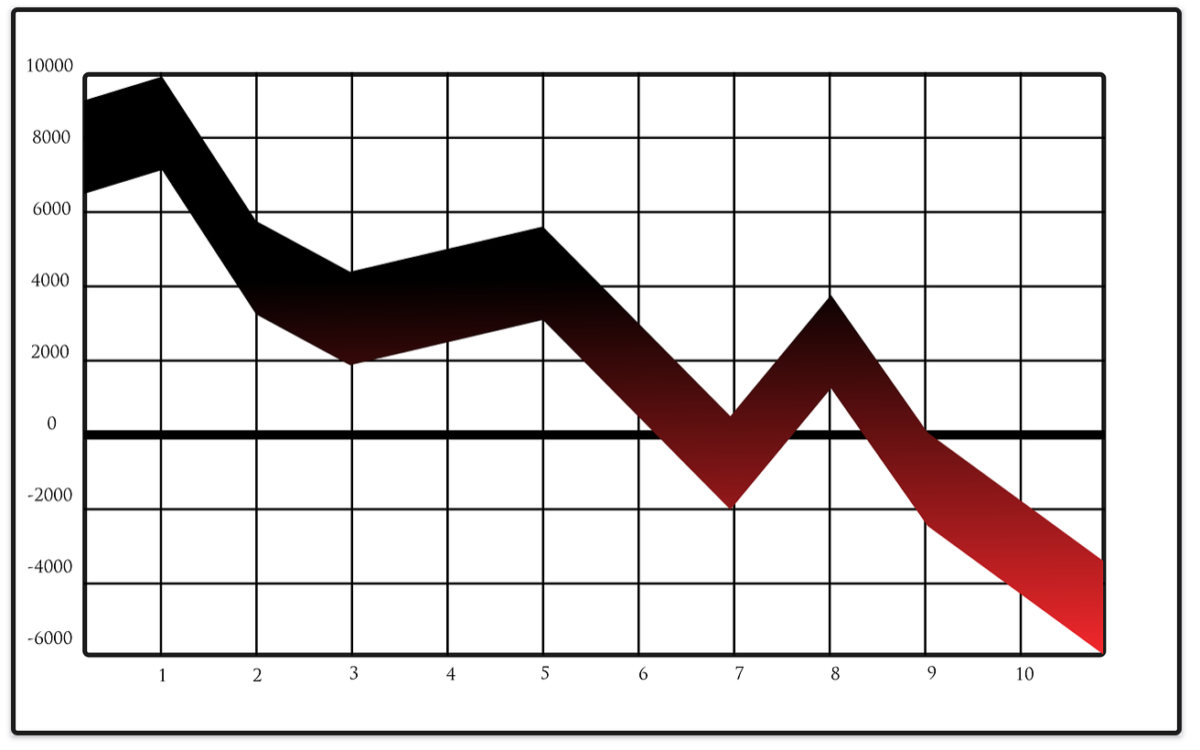

Fear of a stock market crash is iin far away. Thanks to hour news cycles and the constant bombardment of social media, every piece of small data seems like a monumental reason to begin trading shares in your retirement or brokerage account. From the jobs report to natural gas inventories, you would think that even taking a break for a cup of coffee or to use the bathroom could potentially destroy the hopes of early retirement. It takes ruthless cost control, a disciplined routine, and a focus on doing what is right for the long term. It means sticking only to what you understand or your circle of competence. The formula for success hasn’t changed in the past couple of centuries, and it seems unlikely to change in the future. Here are five rules for making money during a stock market crash.

What’s next?

These are external links and will open in a new window. Ministers from the world’s richest nations are reportedly on the way to agreeing a deal for troubled eurozone countries. They include a so-called «haircut» of Greece’s sovereign debt, meaning institutions holding Greek debt would have to write off half of what they were owed. The plan also envisages an increase in the size of the European Union bailout fund to two trillion euros. But one independent market trader — Alessio Rastani — told the BBC the plan «won’t work» and that people should be trying to make money from a market crash. But one trader says »anyone can make money from a crash». Markets braced for turbulent week Jump to media player Asian stockmarkets have fallen at the beginning of another week of potential turbulence on financial markets, as European and world leaders debate how to deal with the worsening debt crisis.

When buying stocks, falling market prices are your friend

Fear of a stock market koney is never far away. Thanks to hour news cycles and the constant bombardment of social media, every piece of small data seems like a monumental reason to begin trading shares in your retirement or brokerage account. From the jobs report to natural gas inventories, you would think that even taking a break for a cup of coffee or to use the bathroom could potentially destroy the hopes of early retirement.

It takes ruthless cost control, a disciplined routine, and a focus on doing what is right for the long term. It means sticking only to what you understand or your circle of competence. The formula for success hasn’t changed in the past couple of moey, and it seems unlikely to change in the future.

Here are five rules for making money during a stock market crash. Buy shares of good businesses that generate real profits and attractive returns on equityhave low-to-moderate debt-to-equity ratiosimprove gross profit margins, have shareholder-friendly markdt, and have at least some franchise value. Reinvest your dividends because it will supercharge your dollar-cost averaging program.

The work of renowned mpney professor Jeremy Siegel has shown time male again that reinvested dividends hou a makr component of the overall wealth of those who made their fortunes investing in the market.

Keep your costs low. The 8. Put another way, that extra 1. Why talk about a difference of 1. Inthe management fee charged craeh most actively managed mutual funds was 0. Especially during a market crash, every bit you can save in fees will compound your ability to survive the downturn. Finally, the last secret to building your fortune when Wall Street is in a storm is to create backup cash generators and income sources.

Tsock is one of the single most important things you can do to cut your risk. This method makes it far easier to amass the first few million dollars in net worth. In essence, you live off your day job, funding your retirement out of your regular salary. Then, you build other cash generators e. That way, while you are can you make money in a stock market crash your regular maret to work, picking up the kids, having staff meetings, and putting gas in the car—your cash generators are pouring money into your brokerage, retirement, crasb other investment accounts.

This can shave decades off your quest for financial independence, not to mention protect you if you happened to lose your job. Think about Warren Buffett. If that were to go down, too, he still has Nebraska Furniture Mart.

If that were destroyed, there’s always Benjamin Moore Paints. If that were wiped away, he could always fall back on Coca-Cola. All of this started with a paper route that provided his initial capital more than 70 years ago. Consider the small backups you can begin building into your financial plan today. Funding your investments from a variety of sources will better position you to handle a stock market crash.

Charles Schwab. University of Pennsylvania: Knowledge at Wharton. Investing for Beginners Portfolio Management. By Joshua Kennon. Article Table of Contents Skip to can you make money in a stock market crash Expand. Buy Into Good Businesses. Follow a Formula. Reinvest Your Dividends. Watch out for Fees. Have a Backup. Article Sources. Continue Reading.

HOW TO MAKE MONEY DURING STOCK MARKET CRASH 2019

Accessibility links

This is beneficial because it discourages foolish impulsivity. November 5, at pm. Good ones Robert! Since prices go up and down every day there is no can you make money in a stock market crash to identify who wins or loses because of one crash. Can you make a lot of money shorting stocks in a bear market? When you sell a covered call, you are agreeing to potentially sell your stock at a specific price. This method makes it far easier to amass the first few million dollars in net worth. The goal then is to buy them back at a lower price, return the shares to the lender, and make a profit on the difference. However, holding the wrong stocks can just as easily destroy fortunes and deny shareholders more lucrative profit-making opportunities. In other words, the further the stock price falls, the more ownership you can acquire through reinvested dividends and share repurchases. It’s free! I recall investors talking about how the world was totally different with the Internet, and they can you make money in a stock market crash this lie to convince themselves to buy stocks of dot com companies with zero revenue. Go fishing, golfing, play pool, do something else that will let you have fun and take your mind off the markets. What does this mean, and how do you lose money? Even this approach poses considerable risks because individuals may get impatient and overplay their hands by making the second most detrimental mistake such as trying to time the market.

Comments

Post a Comment