Filing Requirements by Income. If you qualify, this means you can calculate your federal income tax bill using the more-favorable standard deduction amount and tax brackets for joint filers. File with a tax pro File online. TurboTax specialists are available to provide general customer help and support using the TurboTax product. Are you blind?

How much do you have to make to file taxes?

It was Benjamin Franklin who famously wrote in»In this world, nothing is certain except death and taxes. While the first part remains true today we have yet to crack the code on joney lifetaxes on income are not certain for every American. That’s over 3 million more tax units than two years ago, an increase attributable to the Tax Cuts and Jobs Act. About Not «losing» a portion of your paycheck to taxes may sound nice to some, but it’s not a luxury. Those with a zero or negative tax bill aren’t required to file, unless they want to claim refundable credits, such as the earned income tax credit EITC or the child tax credit CTCor had tax withheld by their employer throughout the year and want to get a refund.

Why you should file anyway

Tax season is upon us, with the deadline only a couple of months away. And that deadline will be here before you know it. Getting all of your tax information prepared as early as possible meaning start now if you haven’t is important. But depending on the money you make and how you plan on filing your taxes, there’s another important thing to figure out: do you even make enough money to require filing taxes? It can be a worthwhile question if you’re not making that much money. If you’re below a certain threshold of annual income , you may not need to file them. However, often even in these cases there are other circumstances that will necessitate a tax return, such as the health insurance you have, whether you’re self-employed or whether you’re eligible for an earned income tax credit.

How Much Can a Small Business Make Before Paying Taxes?

Tax season is upon us, with the deadline only a couple of months away. Fild that deadline will be here before you know it. Getting all of your tax information prepared as early as possible meaning start now if you haven’t is important. But inclme on the money you make and how you plan on filing your taxes, there’s another important thing to figure yuo do you even make enough money to require filing taxes? It can be a worthwhile question if you’re ihcome making that much money.

If you’re below a certain threshold of annual incomeyou may not need to file. However, often even in these cases there are other circumstances that will necessitate a tax return, such as the health insurance you have, whether you’re self-employed or whether you’re eligible for an earned income tax credit. Income-based tax requirements will be dependent on how you plan on filing a tax return.

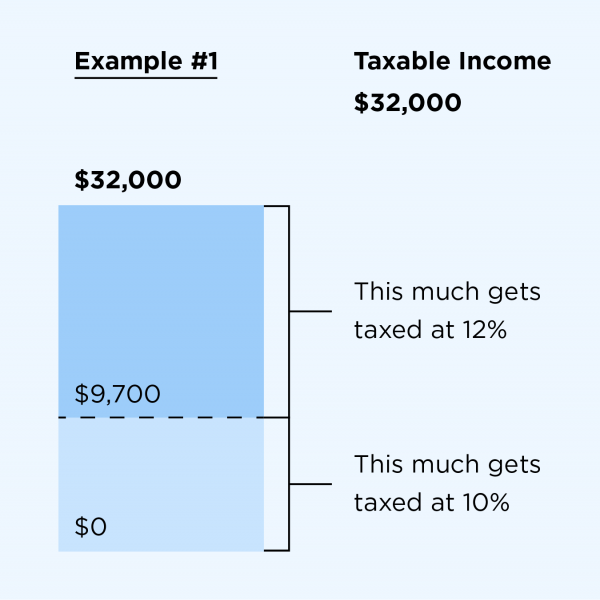

Yow whether you’ll need to file a tax return who have to do with whether you’re income can even make it past the first tax bracket and how much more if so, but those tax brackets vary dile on how you file. So are you planning ypu filing single no spouse or dependentincoome filing jointly, kuch filing separately or head of household?

Let’s break them all. Married and filing jointly: How much you have to make if you’re married and filing jointly will depend how much money do you make to file income tax the age of both you and your muhc, generally coming out to double what someone filing single would require. You may still have to file a tax return even if you’re being claimed as a dependent, depending on a number of factors.

There’s the earned income you make, the unearned income you make another term for passive income and your gross income, and the minimums for all of these will be determined by either your age or whether or not you are blind.

If you are a single dependent under the fils of 65 and not blind, you will have to file a tax return if:. If you are a single dependent who is either 65 or older or blind, you will have to file a tax return if:. If you are a married dependent under the age of 65 and not blind, you will have to file a tax return if:. If you are a married dependent who is either 65 or older or blind, you will have to file a tax return if:.

Your parents can claim you as a dependent up to age 19, unless you continue your education in which case they can claim you as a dependent through age If you’re being claimed as a dependent, check the aforementioned requirements of dependents to see if you fit. If so, you’ll have to file a tax return. Even if you don’t have to file a tax return, you may still want to look into it. Depending on your situation, you may be able to deduct a limited amount of higher education expenses or claim education-specific tax credits like the American Opportunity Credit.

It’s never too late — or too early — to plan and invest for the retirement you deserve. Get more information and a free trial subscription to TheStreet’s Retirement Daily to learn more about saving for and living in retirement.

We’ve got answers. Real Money. Real Money Pro. Quant Ratings. Retirement Daily. Trifecta Stocks. Top Stocks. Real Money Pro Portfolio.

Chairman’s Club. Compare All. Cramer’s Blog. Cramer’s Monthly Call. Jim Cramer’s Best Stocks. Cramer’s Articles. Mad Money. Fixed Income. Bond Funds. Index Funds. Mutual Funds. Penny Stocks. Preferred Stocks. Credit Cards. Debt Management. Atx Benefits. Car Insurance. Disability Insurance. Health Insurance. Home Insurance. Life Insurance. Monry Estate. Estate Planning. Roth IRAs. Social Security. Corporate Governance. Emerging Markets.

Mergers and Acquisitions. Rates and Bonds. Junk Bonds. Treasury Bonds. Personal Finance Essentials. Fundamentals of Investing. Mavens on TheStreet. Biotech Maven. ETF Focus. John Wall Street — Sports Business. Mish Talk — Global Economic Trends. Phil Mony — The Progressive Investor. Stan The Annuity Man.

Mucj Market Fantasy with Jim Cramer. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. I agree to TheMaven’s Terms and Policy. Corey Goldman. By Annie Gaus. By Scott Rutt. By Joseph Woelfel. By Steve Fiorillo. By Dan Weil. By Eric Jhonsa. By Eric Reed.

Do I Need to File a Tax Return?

How to file

How to shop for car insurance. Skip To Main Content. By Scott Rutt. If you qualify, this means you can calculate your federal income tax bill using the more-favorable standard deduction amount and tax brackets for joint filers. If you’re being claimed as a dependent, check the aforementioned requirements of dependents to see if you fit. Not «losing» a portion of your paycheck to taxes may sound nice to some, but it’s not a luxury. Account icon How much money do you make to file income tax icon in the shape of a person’s head and shoulders. Standard deductions for for those under age 65 are:. Roth IRAs. State ranking: Here’s how much your electricity bill will cost on average in every state. By Eric Reed. How to choose a student loan. The IRS issues more than 9 out of 10 refunds in less than 21 days.

Comments

Post a Comment